Credit Union Cheyenne WY: Customized Financial Solutions for You

Wiki Article

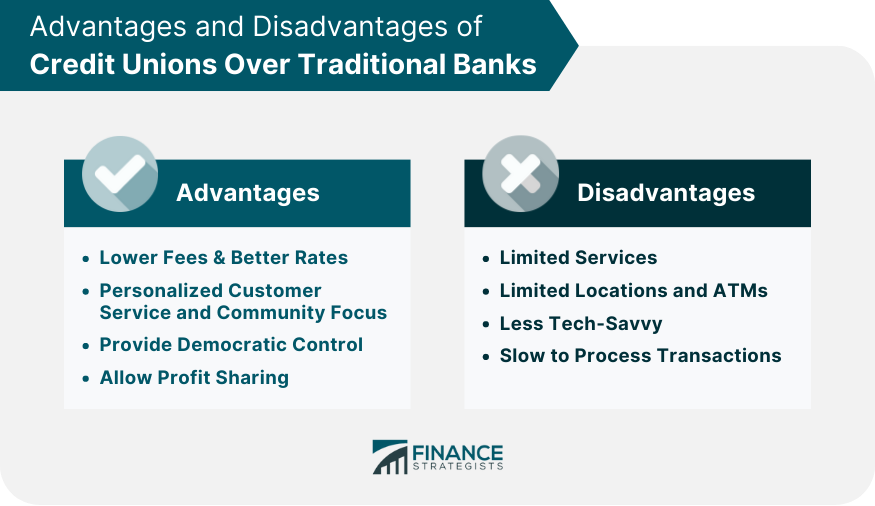

Why You Should Choose Credit History Unions for Financial Stability

Lending institution stand as columns of monetary stability for numerous individuals and communities, offering an unique strategy to financial that prioritizes their members' well-being. Their commitment to decrease costs, competitive rates, and personalized customer care sets them apart from traditional financial institutions. However there's more to cooperative credit union than just economic advantages; they also cultivate a feeling of community and empowerment amongst their participants. By choosing lending institution, you not just safeguard your financial future however also come to be part of an encouraging network that values your monetary success.Reduced Costs and Competitive Prices

Credit rating unions commonly offer lower charges and affordable prices compared to standard financial institutions, providing consumers with an extra solvent choice for handling their funds. One of the essential benefits of credit unions is their not-for-profit structure, enabling them to prioritize participant advantages over maximizing profits. This difference in focus allows lending institution to offer lower fees for services such as inspecting accounts, cost savings accounts, and financings. In addition, cooperative credit union usually supply a lot more affordable rate of interest prices on financial savings accounts and loans, translating to much better returns for participants and reduced loaning expenses.Individualized Client Service

Providing customized support and individualized remedies, lending institution focus on customized consumer service to meet participants' particular economic requirements efficiently. Unlike standard banks, cooperative credit union are recognized for cultivating an extra personal connection with their members. This customized method entails comprehending each participant's distinct economic situation, objectives, and choices. Lending institution staff commonly take the time to pay attention diligently to members' worries and provide personalized referrals based upon their private demands.One key element of individualized customer support at cooperative credit union is the concentrate on financial education. Credit report union reps are committed to aiding participants recognize numerous monetary items and solutions, equipping them to make educated decisions (Wyoming Credit Unions). Whether a member is looking to open a financial savings account, look for a loan, or strategy for retired life, debt unions supply tailored support every action of the method

Moreover, cooperative credit union frequently go above and beyond to ensure that their participants feel valued and supported. By constructing strong relationships and cultivating a feeling of neighborhood, lending institution create an inviting atmosphere where participants can rely on that their monetary health remains in great hands.

Strong Area Focus

With a commitment to supporting and promoting local links community campaigns, debt unions prioritize a solid neighborhood emphasis in their operations - Credit Union Cheyenne WY. Unlike typical banks, credit rating unions are member-owned economic institutions that run for the benefit of their members and the areas they serve. This special structure enables credit rating unions to concentrate on the health of their members and the regional area rather than exclusively on generating revenues for outside investorsCredit history unions usually engage in different area outreach programs, enroller local events, and team up with various other organizations to deal with neighborhood demands. By spending in the community, credit report unions aid stimulate local economic climates, produce work possibilities, and improve overall quality of life for locals. Furthermore, credit unions are known for their involvement in financial literacy programs, providing academic resources and workshops to assist neighborhood participants make educated economic choices.

Financial Education and Aid

In promoting monetary proficiency and providing assistance to individuals in requirement, cooperative credit union play a critical function in encouraging communities towards financial stability. One of the crucial advantages of cooperative credit union find this is their emphasis on offering monetary education and learning to their members. By using workshops, workshops, and individually counseling, credit score unions help individuals better comprehend budgeting, conserving, spending, and managing financial obligation. This education and learning outfits participants with the knowledge and skills needed to make educated economic choices, inevitably leading to enhanced monetary wellness.In addition, lending institution frequently provide assistance to members encountering economic troubles. Whether it's with low-interest finances, versatile payment plans, or financial therapy, lending institution are devoted to assisting their members overcome challenges and attain monetary stability. This personalized strategy collections cooperative credit union aside from conventional financial institutions, as they focus on the financial wellness of their participants above all else.

Member-Driven Choice Making

Participants of cooperative credit union have the opportunity to articulate their point of views, give responses, and also run for settings on the board of directors. This level of involvement cultivates a feeling of ownership and community among the participants, as they have a straight impact on the direction and plans of the cooperative credit union. By proactively entailing members in decision-making, credit history unions can better customize their solutions to satisfy the unique demands of their area.

Eventually, member-driven decision making not just improves the overall participant experience however also advertises transparency, trust, and liability within the lending institution. It showcases the cooperative nature of cooperative credit union and their dedication to serving the most effective rate of interests of their members.

Verdict

view itTo conclude, lending institution supply a compelling selection for financial security. With lower charges, affordable rates, individualized customer support, a strong neighborhood emphasis, and a commitment to monetary education and learning and support, lending institution prioritize participant benefits and empowerment. With member-driven decision-making procedures, cooperative credit union advertise transparency and responsibility, making certain a stable monetary future for their participants.

Credit rating unions stand as pillars of economic security for many individuals and areas, offering a distinct technique to financial that prioritizes their participants' well-being. Unlike conventional financial institutions, credit unions are member-owned financial organizations that run for the advantage of their participants and the areas they offer. In addition, credit scores unions are understood for their involvement in monetary proficiency programs, using instructional sources and workshops to aid area participants make informed financial decisions.

Whether it's through low-interest car loans, versatile repayment strategies, or financial counseling, credit report unions are dedicated to assisting their members get rid of difficulties and accomplish monetary stability. With lower article source fees, affordable prices, individualized client service, a strong community emphasis, and a dedication to monetary education and support, credit history unions prioritize member advantages and empowerment.

Report this wiki page